CEIC leverages its unique data resources to provide multi-strategy investors with a barometer for insights into macroeconomic trends, combined with proprietary nowcasts and alternative datasets.

Leverage the machine learning-driven nowcasts to predict current economic conditions, covering developed markets and offering unique insights into emerging markets—and link these trends to equity markets, currencies, and more.

Utilize the market-leading Point-in-Time (PiT) data library to capture data revisions—this is crucial for back-testing models that forecast the future.

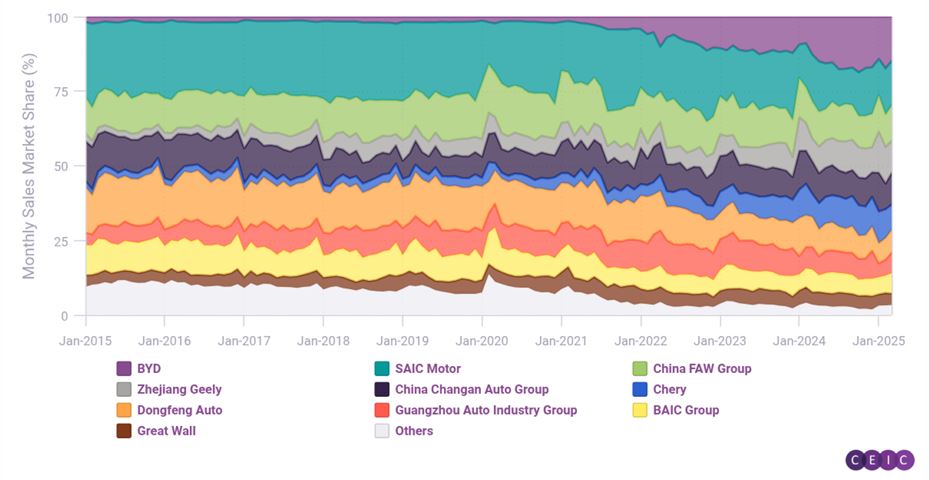

Explore hard-to-source alternative datasets to support forward-looking insights into market changes, including real-time credit card spending, U.S. job postings, and market share data for automotive and technology brands in China.

CEIC delivers the most timely insights into economic turning points in the market. Through the chart collection, understand how CEIC data predicts growth signals, monetary policy, and beyond.

Nowcasting: identify early turning points for EM economies

“Nowcasting” the US stock market: GDP is linked to small-caps

Nowcast Vs. Nowcast: US vs EU GDP correlates with EUR/USD

Revisions matter: the market’s longest archive of Point-in-Time data

High-frequency US job data: an alternative signal for labor weakness

High-frequency credit-card data tracks German consumer mood

Alternative data captures tech brands’ shifting popularity in China

The EV transition in China: emerging automakers jostle for position

To access details, please first log in to the CEIC Database via the link below.